In this section, we compare cash inflow and cash outflow of financing activities. In this section, we compare cash inflow and cash outflow of investment activities. you can learn list of these items at here. You can learn list of these items at here.ĭeduct : Increase in current assets and decrease in current liabilities after comparing two years figures.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

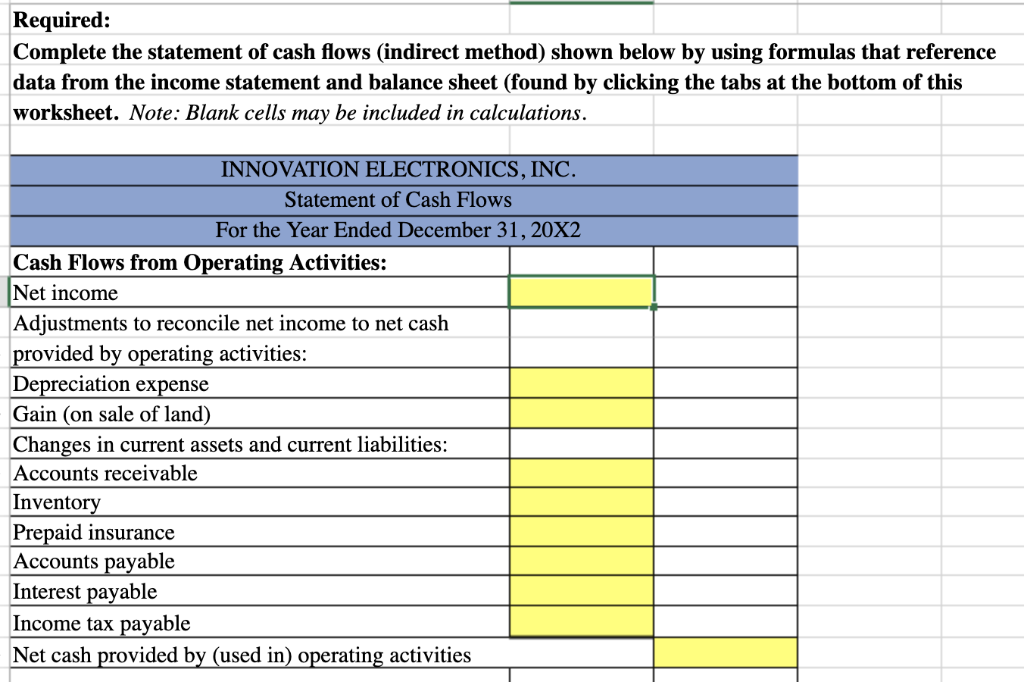

You can learn list of these incomes at here.Īdd : decrease in current asset and increase in current liabilities after comparing two years figures. You can learn its list at here.ĭeduct : Non- cash and non operating incomes from what balance will we receive after adding above. It means we are interested what amount of net profit in the form of cash from business operation.įor this take, net profit or net income as per above givenĪdd : Non - cash and non- operating expenses and losses. Opening and closing balance is already given, now you will just know following figure It means, it will not be benefited just solve this question but to tell the complete procedure of making it is useful for you because in future, you will become corporate accountant and to make these type of cash flow statement will be the part of your duty.Īs per indirect method, what is cash flow statementĬash from operation + cash from investment + cash from financing + opening balance of cash = closing balance of cash This cash flow statement is compulsory for every company. I think in your book, there may 20 or 25 questions just relating to this but changing of figures. Actual this question or any other cash flow statement questions are so easy if we know its correct process. Suraj Rana! First of all your thanks for writing and sending this question in accounting education. Use the indirect approach, and include required supplemental information about cash paid for interest and taxes. Prepare Fred Slezak's statement of cash flows for the year ending 2005. The income statement for the year ending December 31, 2005, included the following key amounts:

The increase in paid-in capital resulted from issuing additional shares for cash. Equipment was purchased during the year in exchange for a promissory note payable. The decrease in land resulted from the sale of a parcel at a $45,000 loss. Prepaid items related only to advertising expenses. Total Liabilities and equity $2,454,000 $1,819,000Īdditional information about transactions and events occurring in 2005 follows:ĭividends of $55,000 were declared and paid.Īccounts payable and accounts receivable relate solely to purchases and sales of inventory. Paid-in capital in excess of par 800,000 400,000 "Fred Slezak presented the following comparative balance sheet:

CASH FLOW STATEMENT INDIRECT METHOD SOLVED EXAMPLES HOW TO

How to Solve this Cash Flow Statement problem

0 kommentar(er)

0 kommentar(er)